Welcome back, Walbi traders! In our journey through Walbi Academy, you've equipped yourselves with powerful analytical skills and begun to leverage AI in your strategies. Now, it's time to refine one of Walbi's most engaging and potentially rewarding features: Walbi Predictions.

Walbi Predictions offers a unique opportunity to test your market intuition and earn rewards by forecasting short-term price movements. It’s a dynamic feature that combines fast-paced market analysis with a competitive edge. This lesson will take a deep dive into its mechanics, effective strategies, and crucial risk management considerations, helping you sharpen your predictive instincts.

1. A Deep Dive into the Mechanics of Walbi Predictions

At its core, Walbi Predictions is about forecasting whether an asset's price will go UP or DOWN within a specific timeframe. Understanding the underlying mechanics is key to playing smart.

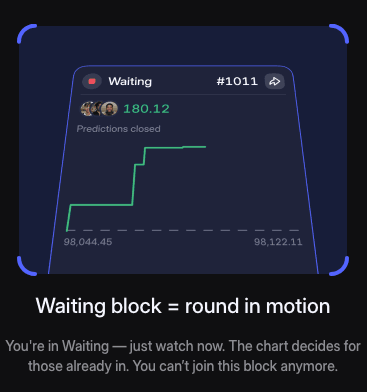

- Fixed Time Blocks: Walbi Predictions operates on pre-defined, fixed time blocks (e.g., 5-minute, 15-minute intervals). At the start of each block, a new prediction round begins. Your task is to predict the price movement from the start to the end of that specific block.

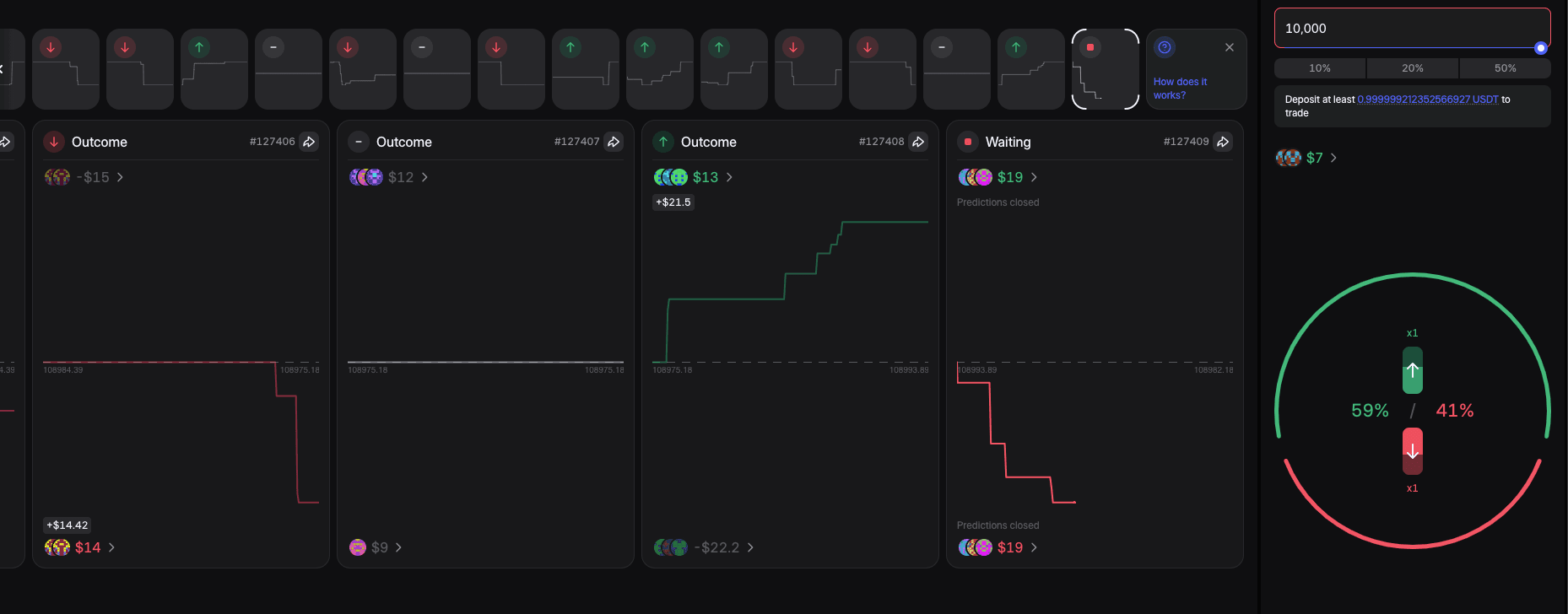

- Opposing Predictions: For each block, you'll be making an "UP" or "DOWN" prediction. The platform pools all "UP" and "DOWN" wagers, creating an opposing dynamic. Your payout is directly influenced by the collective predictions of other participants.

- Outcome Determination: At the end of each fixed time block, the platform automatically determines the outcome based on the asset's closing price compared to its opening price for that block. If the closing price is higher, "UP" predictions win. If lower, "DOWN" predictions win. Ties are typically refunded.

- Decentralized and Transparent: The outcomes are determined by verifiable price feeds, ensuring transparency and fairness in the prediction process.

2. Strategies for Making Informed UP/DOWN Predictions

While Walbi Predictions involves an element of short-term market speculation, informed decisions are always better than blind guesses. Here are some strategies to sharpen your insights:

- Short-Term Technical Analysis:

- Candlestick Patterns: Pay close attention to candlestick patterns forming on the chart within shorter timeframes (e.g., 1-minute, 5-minute charts). Patterns like dojis, hammers, or engulfing candles can signal potential reversals or continuations.

- Support & Resistance: Identify immediate support and resistance levels. If the price is nearing a strong resistance, a "DOWN" prediction might be more logical, and vice-versa for support.

- Volume Analysis: Spikes in trading volume often accompany significant price moves. A sudden surge in volume accompanying an upward or downward thrust can provide conviction for your prediction.

- Candlestick Patterns: Pay close attention to candlestick patterns forming on the chart within shorter timeframes (e.g., 1-minute, 5-minute charts). Patterns like dojis, hammers, or engulfing candles can signal potential reversals or continuations.

- Momentum Indicators: While not exhaustive, quick glances at indicators like RSI (Relative Strength Index) or MACD (Moving Average Convergence Divergence) on short timeframes can give a sense of overbought/oversold conditions or shifting momentum.

- News & Event Awareness (Brief): For very short timeframes, major, immediate news (e.g., a flash crash on a major exchange, a sudden regulatory announcement) can trigger rapid price movements. While hard to act on in seconds, being aware of such black swan events can inform a quick prediction.

- Observing Initial Moves: Sometimes, the first few seconds of a new block can indicate immediate momentum. While risky to solely rely on, it can be a factor.

3. Utilizing the 'Multiple Deals Within the Same Block' Feature for Hedging and Risk Management

Walbi's "multiple deals within the same block" feature is a powerful tool, not just for increasing potential wins, but crucially, for implementing hedging and risk management strategies.

- Diversifying Predictions: Instead of putting all your chips on one "UP" or "DOWN" prediction, you can spread your capital across multiple smaller predictions within the same block. For example, if you're uncertain, you could make a smaller "UP" prediction and a smaller "DOWN" prediction. While this limits maximum profit, it also limits maximum loss.

- Hedging Uncertainty: If the market is choppy or a key resistance/support level is being tested, you might place an initial prediction, and if the price moves against you slightly but you still believe in your original direction, you could place a smaller, opposing prediction to "hedge" part of your initial exposure. This isn't about guaranteeing a win, but about managing the potential downside.

- Scalping Within the Block: For very active traders, this feature allows for mini-strategies within a single prediction block. You might predict UP, profit from a quick move, and then if momentum shifts, immediately make a DOWN prediction in the same block to capitalize on the reversal.

- Discipline is Key: While multiple deals offer flexibility, they also demand discipline. Avoid chasing losses by constantly flipping your prediction. Have a plan for how you'll use this feature before the block begins.

4. Understanding the Platform's Consideration Structure for Winning Predictions

The way Walbi distributes winnings is designed to be fair and transparent, reflecting the collective pool of predictions.

- The Prize Pool: For each prediction block, all the "considerations" (stakes) from both "UP" and "DOWN" predictions form a total prize pool.

- Winner's Share: The winning side (e.g., "UP" predictions if the price goes up) shares this total prize pool proportionally to their individual consideration, after Walbi's platform fee is deducted.

- Dynamic Payouts: This means your exact payout isn't fixed beforehand. If many people predict correctly, your share of the pool might be smaller. If fewer people predict correctly, your share will be larger. This dynamic adds an interesting layer to the strategy – sometimes the "less obvious" correct prediction yields a higher return.

- Transparency: Walbi strives for transparency, showing the total consideration for both UP and DOWN sides before the block closes, giving you an idea of the collective market sentiment.

5. Practical Tips for Engaging with the Predictions Feature Effectively

To truly master Walbi Predictions, blend theoretical understanding with practical application.

- Start Small: Begin with minimal consideration amounts. This allows you to gain experience, understand the feature's nuances, and develop your instincts without significant financial risk.

- Focus on One Asset: Especially when starting, concentrate your predictions on a single, highly liquid asset (like BTC/USDT or ETH/USDT). Their price movements are often more predictable based on technicals.

- Record Your Predictions: Keep a simple journal. Note down your prediction (UP/DOWN), the asset, the time block, your reasoning (e.g., "saw hammer candle"), and the outcome. This helps you learn from successes and mistakes.

- Manage Your Emotions: The fast pace of predictions can be exhilarating, but also emotionally taxing. Avoid chasing losses or letting FOMO (Fear Of Missing Out) drive your decisions. Stick to your strategy.

- Don't Over-Predict: You don't need to predict every block. Only engage when you feel you have a clear edge or a strong conviction based on your analysis. Sometimes, the best prediction is no prediction.

- Understand the Fees: Be aware of any small fees Walbi applies to predictions, as these will affect your net profit.

Conclusion

Walbi Predictions is more than just a guessing game; it's a powerful tool for sharpening your short-term market analysis skills and earning rewards. By understanding its core mechanics, employing informed strategies, leveraging its unique features for risk management, and engaging responsibly, you can transform your market intuition into tangible results.

Start experimenting with Walbi Predictions today and witness your predictive instincts transform into a real edge!

Don't forget to catch up on Walbi Academy: Course 8.1 HERE