Liberte os agentes comerciais de IA da Walbi! Aprenda a configuração especializada, os parâmetros, o monitoramento de desempenho e o uso responsável para obter uma vantagem inteligente na negociação de criptomoedas.

Bem-vindo de volta à Walbi Academy, comerciantes astutos! Em nossos cursos anteriores, você construiu uma base sólida em pesquisa, análise e negociação responsável de criptomoedas. Agora, é hora de aprimorar seu jogo e mergulhar em um dos recursos mais poderosos e inovadores do Walbi: Agentes comerciais de IA da Walbi.

Em um mercado cada vez mais acelerado e complexo, a capacidade de processar grandes quantidades de dados, identificar padrões sutis e reagir com a velocidade da luz não é mais apenas uma vantagem — é uma necessidade. É aqui que os agentes comerciais de IA da Walbi entram em cena, oferecendo a você uma vantagem inteligente em sua jornada de negociação. Esta lição o guiará por tudo o que você precisa saber, desde configurar seus agentes até entender seus sinais e, principalmente, usá-los com responsabilidade.

1. Configuração e configuração detalhadas dos agentes comerciais de IA da Walbi

A introdução aos Agentes de Negociação de IA da Walbi foi projetada para ser intuitiva, mas oferece camadas de personalização para quem busca um controle preciso.

Configuração passo a passo:

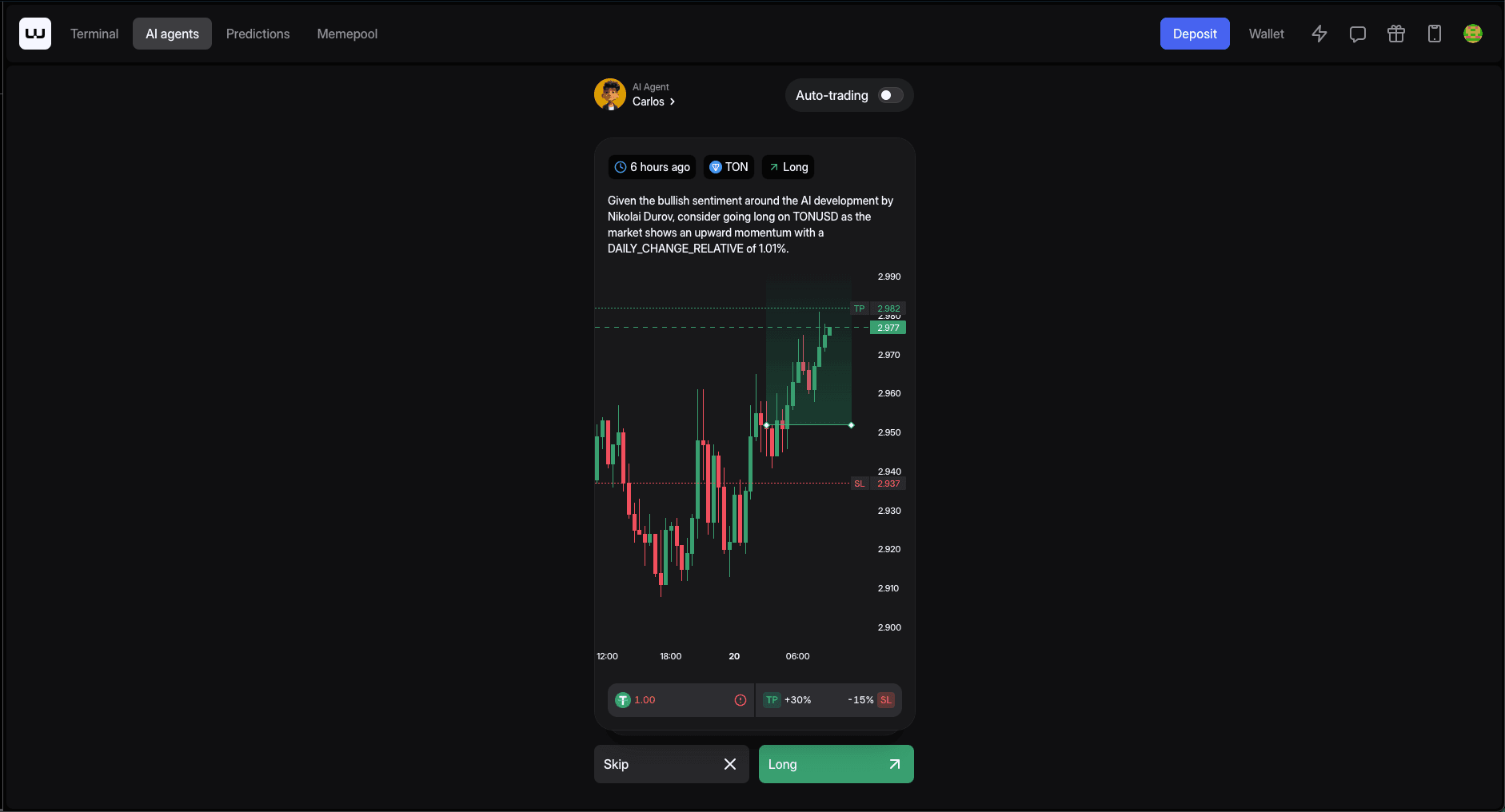

- Acesse a seção Agente de IA: Dentro do seu Plataforma Walbi, navegue até a seção dedicada “Agentes de IA” no canto superior esquerdo.

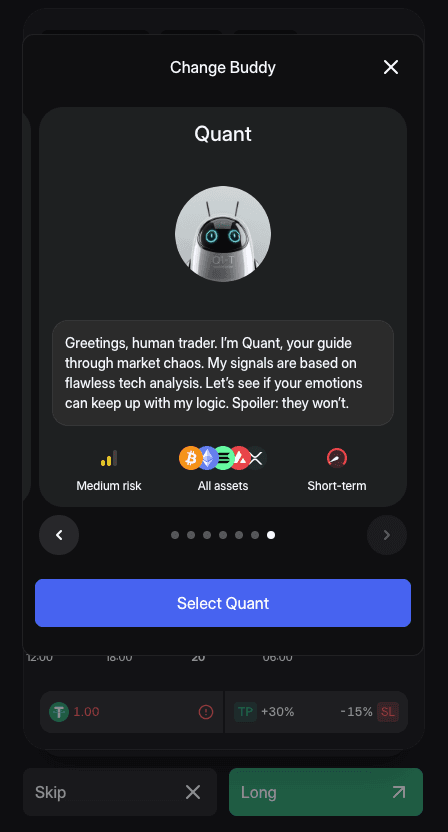

- Procure agentes disponíveis: A Walbi oferece um conjunto de agentes de IA distintos, cada um projetado com diferentes estilos de negociação e apetites de risco em mente. Por exemplo:

- “Mamãe”: Um agente conservador, geralmente focado no BTC e evitando alta alavancagem.

- “Baleia MC”: Um agente mais agressivo, otimizado para mercados de escalpelamento e rápida evolução.

- Outros agentes especializados que atendem a vários níveis de risco e preferências estratégicas.

- Selecione seu agente: Analise cuidadosamente as descrições de cada agente. Escolha aquele que melhor se alinha às suas metas pessoais de negociação, tolerância ao risco e aos ativos que você deseja negociar

4. Configuração inicial: Depois de selecionada, a plataforma o guiará pela configuração inicial. Isso normalmente envolve:

- Selecione um insight: O agente escolhido fornecerá uma visão baseada em IA, oferecendo a opção de comprar ou vender uma determinada criptomoeda. Se você não gostar do insight, clique em “pular” para ir para o próximo.

- Parâmetros de risco: Defina controles básicos de risco. Embora a IA tenha um gerenciamento de risco integrado, muitas vezes você terá opções para perda diária máxima, máximo de posições abertas ou gatilhos específicos de stop-loss.

- Pares de negociação: Agentes diferentes sugerem pares de negociação diferentes. Portanto, revise todos os detalhes do agente para ver qual par você deseja negociar.

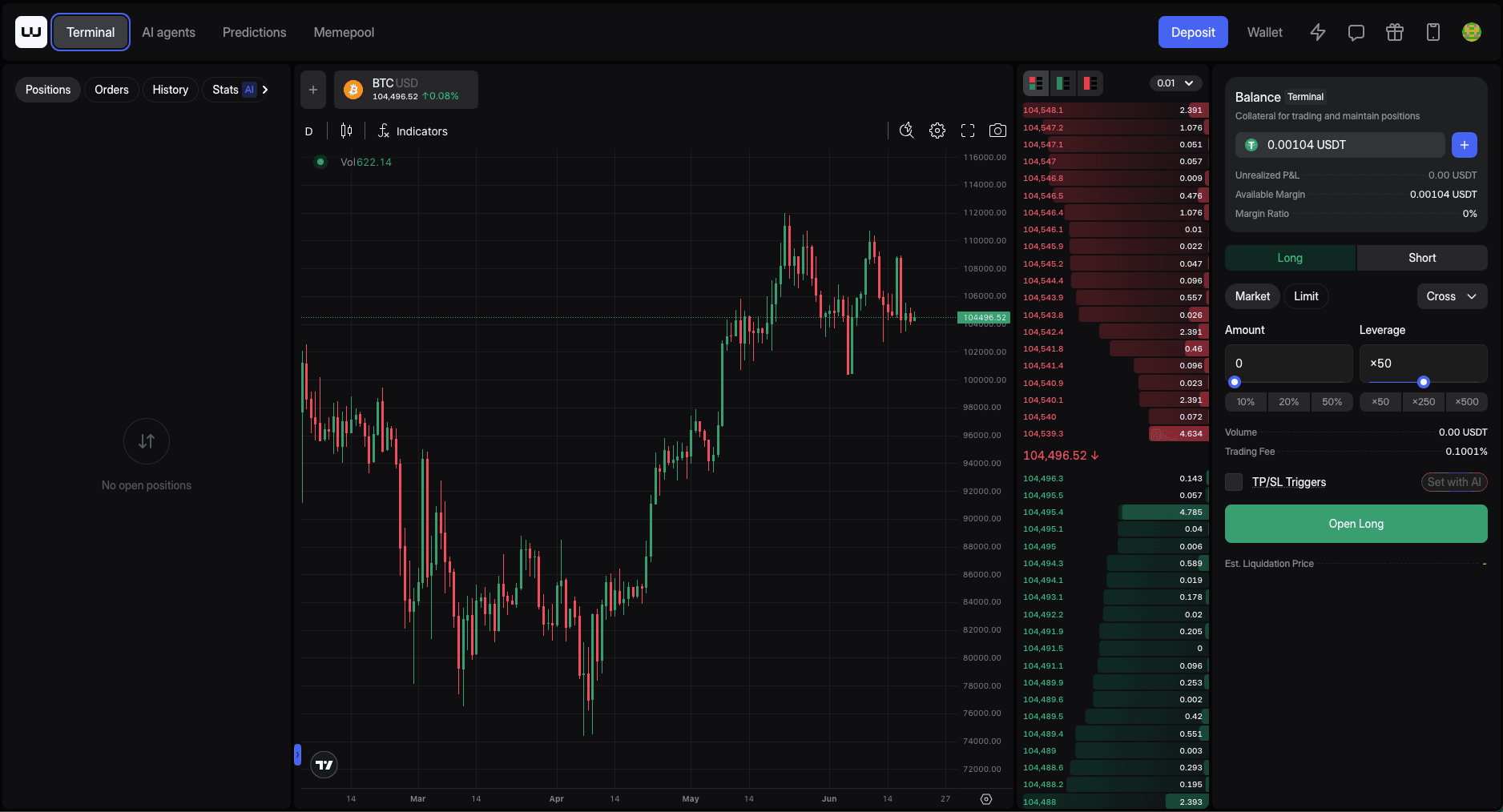

- Terminal: Depois de abrir uma posição, navegue até o Terminal à esquerda para ver todas as suas posições abertas.

2. Entendendo os parâmetros, modos e opções de personalização do AI Agent

Os agentes de IA da Walbi são ferramentas sofisticadas, e entender seus parâmetros e modos subjacentes é fundamental para uma utilização eficaz.

- Estilos/modos de negociação: Além de serem conservadores ou agressivos, os agentes podem operar em diferentes modos:

- Seguindo as tendências: Projetado para capitalizar movimentos sustentados de preços.

- Reversão média: Busca lucrar com o retorno dos preços à média.

- Arbitragem: Explora pequenas diferenças de preço entre as bolsas (embora isso geralmente seja muito frequente e específico).

- Escalpelamento: Concentra-se em ganhos pequenos e frequentes em mercados altamente líquidos.

- Capacidades de processamento de dados: Os agentes de IA da Walbi são projetados para processar informações de mercado muito mais rápido do que os humanos. Eles rastreiam simultaneamente vários fluxos de dados, incluindo:

- Movimentos de preços em tempo real em várias bolsas.

- Transações com carteira de baleias (monitoramento de grandes movimentos de capital).

- Análise de sentimentos nas redes sociais.

- Notícias de milhares de fontes.

- Indicadores técnicos em vários períodos de tempo.

- Essa ampla ingestão de dados permite decisões mais informadas, especialmente durante eventos complexos de mercado.

- Opções de personalização: Dependendo do agente específico e do conjunto de recursos do Walbi, você poderá ajustar parâmetros como:

- Metas de lucro: Definir limites específicos para obter lucros.

- Prazos: Direcionar a IA para se concentrar nos sinais gerados a partir de determinados períodos de tempo (por exemplo, gráfico de 15 minutos, gráfico de 4 horas).

- Risco por negociação: Definir a porcentagem de capital alocado arriscado por negociação individual.

3. Interpretando sinais e recomendações gerados por IA para uma execução ideal

Embora os agentes de IA da Walbi possam automatizar a negociação, um ponto forte geralmente está em sua capacidade de fornecer sinais e recomendações acionáveis que você pode escolher executar.

- Geração de sinal: A rede neural da IA analisa constantemente os dados para gerar sinais de negociação personalizados. Eles podem aparecer como:

- Alertas de “compra” ou “venda” para ativos específicos.

- Metas de preço ou sugestões de stop-loss.

- Notificações de eventos de mercado significativos detectados pela IA.

- Execução “Deslize para a direita”: A interface amigável do Walbi geralmente permite uma execução rápida. Se um sinal aparecer e você concordar com ele, basta “deslizar para a direita” ou clicar em um botão para iniciar a negociação com parâmetros pré-preenchidos.

- O julgamento humano continua sendo fundamental: É fundamental lembrar que, embora a IA ofereça velocidade e processamento de dados incríveis, ela não é infalível. Walbi geralmente enfatiza um humano no circuito abordagem. Isso significa:

- Confirmação: Use os sinais da IA como uma poderosa segunda opinião ou um aviso para sua própria análise mais profunda.

- Compreensão contextual: A IA pode ignorar nuances de eventos do mundo real (por exemplo, mudanças geopolíticas, notícias regulatórias inesperadas) que seu julgamento humano pode considerar.

- Filtrando sinais falsos: Ocasionalmente, em condições de mercado altamente incomuns, a IA pode gerar sinais falsos. Sua supervisão ajuda a filtrá-los.

4. Monitorando as métricas de desempenho do agente de IA na interface Walbi

Uma vez que seu agente de IA esteja ativo, o monitoramento contínuo é vital. O Walbi fornece ferramentas robustas para monitorar seu desempenho.

- Painéis de desempenho dedicados: A interface do Walbi contará com painéis específicos para cada agente de IA ativo, exibindo as principais métricas:

- P&L (lucros e perdas) atuais: Ganhos ou perdas em tempo real para as negociações ativas do agente.

- Desempenho histórico: Um registro detalhado das negociações anteriores executadas pelo agente, incluindo pontos de entrada/saída, lucros/perdas e duração.

- Taxa de vitórias: A porcentagem de negociações lucrativas em relação ao total executado.

- Fator de lucro: A relação entre lucros brutos e perdas brutas, indicando a eficiência do agente.

- Redução máxima: O maior declínio de pico a mínimo no patrimônio líquido do agente, um indicador de risco crucial.

- Duração média da negociação: Por quanto tempo as negociações normalmente permanecem abertas.

- Alertas e notificações: Configure alertas personalizados no Walbi para ser notificado sobre eventos significativos relacionados aos seus agentes de IA, como:

- Novas entradas ou saídas comerciais.

- Limites específicos de lucro/perda sendo atingidos.

- Mudanças nas condições de mercado que podem afetar o desempenho do agente.

- Revisão regular: Crie o hábito de analisar regularmente o desempenho do seu agente de IA em relação às suas expectativas. Suas negociações estão alinhadas com sua estratégia? Está funcionando bem nas condições atuais do mercado? Isso ajuda a determinar se ajustes são necessários ou se um agente diferente pode ser mais adequado.

5. Considerações sobre uso responsável e gerenciamento de riscos ao empregar agentes de IA

Embora os agentes de IA ofereçam um potencial imenso, seu uso responsável é fundamental. Trate-os como ferramentas poderosas que ainda exigem sua supervisão e orientação estratégica.

- Comece aos poucos: Nunca aloque uma parte significativa de seu capital para um agente de IA até que você tenha observado minuciosamente seu desempenho em condições reais de mercado e esteja confortável com seu comportamento.

- Defina objetivos claros: Antes de ativar um agente, saiba exatamente o que você espera que ele alcance (por exemplo, pequenos ganhos consistentes, capitalização em tendências específicas, diversificação).

- Entenda as limitações: A IA é orientada por dados. Ela não consegue prever eventos do “cisne negro” nem reagir a condições de mercado completamente sem precedentes fora de seus dados de treinamento.

- Não abandone sua estratégia: Os agentes de IA têm como objetivo aumentar, e não substituir, sua estratégia geral de negociação e seu plano de gerenciamento de riscos. Eles devem se encaixar em seu gerenciamento mais amplo de portfólio.

- O monitoramento regular não é negociável: Mesmo que eles sejam automatizados, você ainda é o tomador de decisões definitivo. Verifique regularmente suas negociações, desempenho e o contexto do mercado. Esteja preparado para pausar ou ajustar se um agente se desviar das expectativas ou se as condições do mercado mudarem drasticamente.

- Gerenciamento de alavancagem: Se o agente de IA escolhido usar alavancagem, esteja bem ciente dos riscos associados. Mesmo pequenos movimentos percentuais podem levar a oscilações significativas de P&L com alta alavancagem. Estabeleça limites de alavancagem conservadores e nunca sobrecarregue sua conta.

- Distanciamento emocional: Uma das maiores vantagens da IA é a falta de emoção. No entanto, como usuário, garanta seu as emoções não levam você a ignorar decisões sólidas de IA ou, inversamente, a ficar com uma IA de baixo desempenho por esperança. Confie nos dados e nas suas regras predefinidas.

Conclusão

Os agentes de negociação de IA da Walbi representam um avanço significativo na disponibilização de ferramentas de negociação sofisticadas. Ao entender sua configuração, parâmetros, métricas de desempenho e, o mais importante, empregá-los de forma responsável com um gerenciamento de risco robusto, você pode realmente liberar seu potencial para obter uma vantagem poderosa e inteligente no mundo dinâmico da negociação de criptomoedas.

Comece a experimentar os agentes de IA da Walbi hoje mesmo e transforme sua abordagem de negociação com o poder da inteligência artificial!

Artigos relacionados

Programa do Curso 8: Dominando o Walbi - Um mergulho profundo nos recursos da plataforma

Curso 8.2 - Dominando as previsões do Walbi: aguçando seus instintos